In the evolving world of financial services, businesses face mounting pressure to harness data effectively. High-quality data drives customer satisfaction, regulatory compliance, and informed decision-making. But poor-quality data can lead to operational inefficiencies, compliance risks, and financial losses.

This blog explores actionable strategies to improve financial data quality, common challenges, and how Solutionara’s expertise can help you unlock the full potential of your data.

What is Data Quality in Financial Services?

In financial services, data quality refers to the accuracy, consistency, and completeness of information used for business-critical processes. Poor-quality data can derail vital operations, including risk analysis, fraud detection, and compliance reporting.

High-quality financial data supports:

- Accurate financial reporting.

- Loan approvals and underwriting processes.

- Fraud prevention and risk management.

- Predictive analytics and strategic planning.

10 Key Strategies for Financial Data Quality Management

1. Define Data Quality Objectives

Clearly outline what constitutes high-quality data in your organization. For example, ensure financial reports are 100% accurate, customer records are up to date, and transaction logs are error-free. Align these goals with business objectives, such as improving decision-making, regulatory compliance, or enhancing customer trust.

2. Establish Data Quality Standards

Create specific benchmarks for accuracy (e.g., 99.9% correct entries), completeness (e.g., 100% mandatory fields filled), and consistency (e.g., uniform formatting for financial codes). Document these standards and enforce them across all data-related activities.

3. Conduct Data Profiling

Perform a comprehensive analysis of your data to identify gaps, errors, or inconsistencies. Use tools to assess patterns, check for missing values, and validate adherence to predefined standards. For example, scan customer databases for duplicate entries or missing relevant customer details.

4. Automate Data Validation and Cleansing

Leverage modern tools like ETL (Extract, Transform, Load) software to streamline error detection and correction. Automate processes such as removing duplicate entries, standardizing currency formats, and validating transaction data against business rules.

5. Build a Data Governance Framework

Assign accountability by defining roles such as Data Stewards or Data Owners. Create policies to govern data access, storage, and updates. For instance, restrict access to sensitive financial data and establish approval workflows for data changes.

6. Integrate Data from Multiple Sources

Use advanced integration platforms to merge data from disparate sources, such as ERP systems, CRM platforms, and financial databases. Implement master data management (MDM) to ensure a single source of truth, avoiding discrepancies between systems.

7. Regular Monitoring and Reporting

Set up real-time dashboards to monitor key data quality metrics like error rates and missing fields. Implement alerts to flag deviations from benchmarks, ensuring timely corrective actions. For example, track transaction anomalies to mitigate potential financial fraud.

8. Train Teams in Data Management

Offer ongoing training to employees on best practices for data entry, validation, and maintenance. Use workshops, e-learning platforms, or certification programs to promote a culture of accountability and precision in managing data.

9. Use Data Quality Metrics

Regularly monitor and report on metrics such as data accuracy rates, error resolution times, and the completeness of datasets. For instance, track how often financial transactions are flagged for errors and how quickly they are resolved.

10. Commit to Continuous Improvement

Establish a feedback loop by soliciting input from end-users on data usability and quality. Regularly review and update processes, tools, and standards to adapt to evolving business needs and regulatory requirements.

Benefits of High-Quality Data in Financial Services

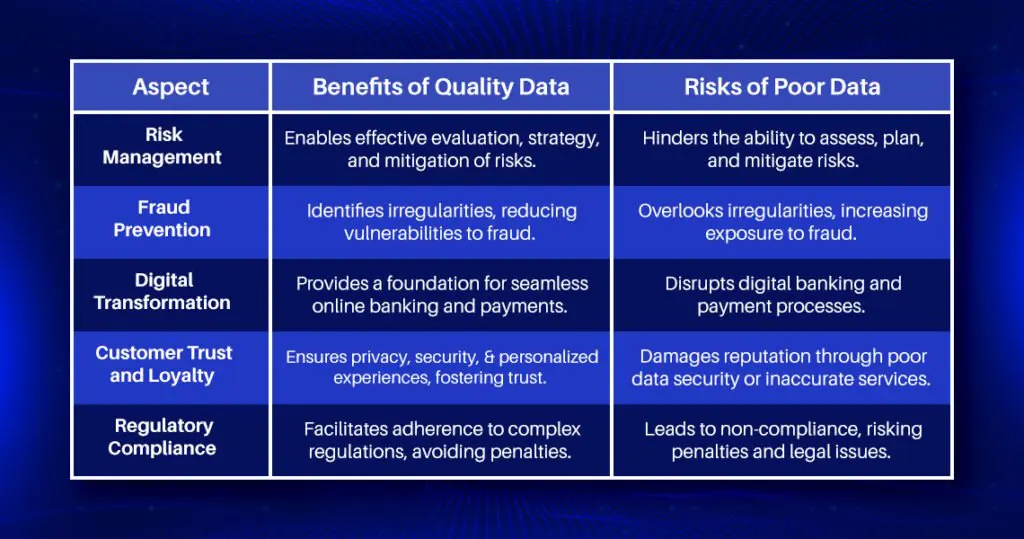

1. Enhanced Risk Management

Precise data empowers organizations to evaluate, strategize, and mitigate financial risks effectively.

2. Fraud Prevention

Consolidated data exposes irregularities, reducing vulnerabilities to fraud.

3. Digital Transformation Enablement

Clean, integrated data lays the foundation for seamless online banking and payments.

4. Customer Trust and Loyalty

High-quality data ensures privacy, security, and personalized experiences, fostering trust.

5. Regulatory Compliance

Accurate data supports adherence to complex financial regulations, avoiding penalties.

Common Data Quality Challenges

Despite its importance, maintaining high data quality can be challenging. Common issues include:

- Inconsistent Formats: Varying formats impede integration.

- Data Redundancy: Duplicate entries inflate costs and create confusion.

- Outdated Information: Obsolete data leads to poor decisions.

- Security Gaps: Vulnerabilities in data security expose sensitive information.

Optimize Financial Data Quality with Solutionara

Navigating the complexities of financial data management requires expertise. Solutionara offers comprehensive solutions to streamline data governance, enhance accuracy, and ensure regulatory compliance.

Ready to take your financial data quality to the next level? Contact Solutionara today to schedule a consultation and discover how our tailored solutions can transform your business.